Importing Commercial Patio Umbrellas via a trading company erodes profits, while a CIF shipment can add non-negotiable charges like a $300 China Import Service Fee. Factory-direct sourcing eliminates these financial risks and communication gaps from the start.

This guide shows how to verify a factory using its ISO 9001 scope, contrast the Linhai cluster with Guangdong, and choose FOB Ningbo over CIF. We’ll also cover AQL 2.5/4.0 inspections and weigh 30/70 T/T payments against an L/C.

The “Real Factory” Test for Commercial Patio Umbrellas: Verification vs. Traders

A “real factory” test verifies a supplier has its own production lines, engineering staff, and quality control systems. This is the key difference from a trading company, which operates as a middleman.

Verification involves checking business licenses, conducting on-site inspections, and reviewing quality certifications like ISO 9001 to confirm their operational status.

| Feature | Direct Factory | Trading Company |

|---|---|---|

| Operations | Owns production lines; employs engineers and workers. | Office-based; coordinates with external factories. |

| Cost Structure | Direct pricing without added margins. | Adds margin to factory price (Higher Cost). |

| Quality Control | In-house QC systems (ISO 9001). | Limited control; inconsistent quality. |

| Communication | Direct access to technical teams for OEM. | Relayed info; causes delays and errors. |

When sourcing products like commercial patio umbrellas, knowing your supplier’s business model is essential. A direct factory owns its production equipment, manages its own workforce, and controls every step from raw material to finished product.

In contrast, a trading company is a sourcing agent. It operates as an intermediary. While they can offer a wide catalog, this often leads to higher costs and less control over quality and timelines.

Working directly with a manufacturer like Patiofurnituresco gives you better cost control and direct communication. It removes the extra layer, ensuring your technical specifications for OEM/ODM projects are understood by the engineers actually building the product.

How to Verify a Supplier: A Practical Checklist

Performing due diligence protects your investment. A few straightforward checks can help you confirm whether you’re dealing with a real manufacturer.

- Review the Business License: A manufacturer’s license will list “Production” or “Manufacturing”. A trading company’s license will state “Trading” or “Wholesale”.

- Conduct a Factory Tour: Ask for a detailed virtual tour. Look for active machinery and raw material inventory, not just a polished showroom. [Request a Virtual Tour of Our Linhai Factory]

- Request Technical Documents: A real factory can provide material certificates and internal testing reports (like ASTM E2500).

Industrial Clusters for Commercial Patio Umbrellas: Why Location Matters

Your factory’s location in China impacts cost and logistics. The Linhai/Ningbo area in the Yangtze River Delta provides specialized manufacturing hubs for commercial umbrellas, paired with world-class logistics through the Port of Ningbo.

Two dominant mega-regions lead the way: Guangdong Province and the Yangtze River Delta (YRD). Choosing between them depends on your product needs.

| Feature | Linhai (Taizhou) | Ningbo | Guangdong |

|---|---|---|---|

| Primary Role | Specialized Manufacturing | Global Logistics Hub | Mega-Scale Production |

| Production Focus | Patio Umbrellas & Furniture | Port Services & Trade | Electronics & General Goods |

Sourcing Analysis: Specialization vs. Scale

Linhai is the heart of China’s outdoor furniture industry. Operating our factory in Linhai gives us a distinct advantage. We have direct access to specialized materials and a skilled workforce, allowing us to build commercial patio umbrellas with greater efficiency.

Ningbo’s world-class port is a gateway for exports from Linhai. This proximity significantly reduces inland transportation costs and shortens lead times.

Incoterms Decoded: Shipping Commercial Patio Umbrellas (FOB vs. CIF)

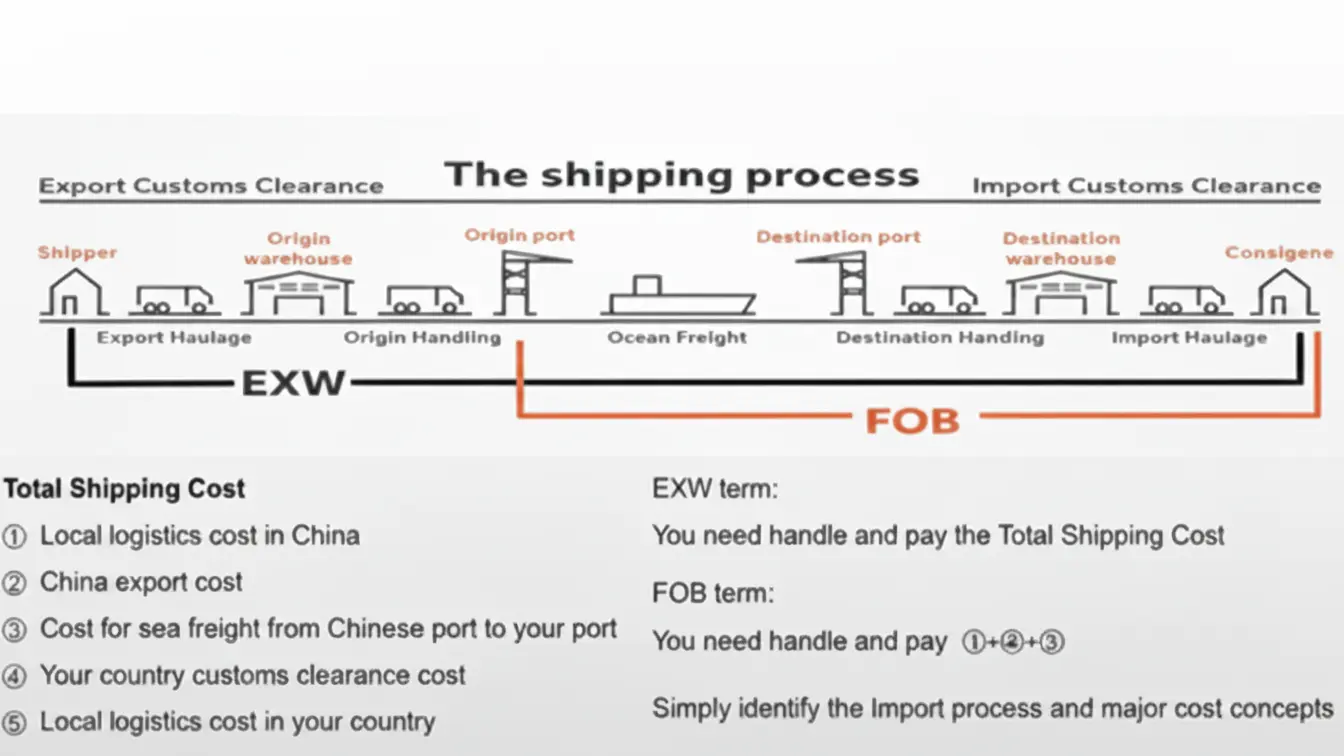

While both FOB and CIF transfer risk once goods are on the ship, they differ greatly in cost control. FOB gives the buyer authority over shipping costs; CIF can lead to expensive, non-negotiable charges.

FOB vs. CIF: The Same Risk Transfer Point

Under Incoterms 2026, both FOB (Free On Board) and CIF (Cost, Insurance, and Freight) define the risk transfer point identically: when goods are loaded on the vessel.

Cost Control: Avoid the $300 Hidden Fee

The primary difference is financial control. CIF shipments from China often face non-negotiable fees like a China Import Service Fee (CISF), which can exceed $300.

Working with a direct manufacturer like Patiofurnituresco allows you to choose FOB terms, helping you avoid these surprises.

Your Factory-Direct Partner for Custom Commercial Umbrellas

The “Golden Week” Factor: Planning Commercial Umbrella Orders Around CNY

China’s major holidays cause system-wide disruptions. To prevent delays, confirm production 4-6 weeks prior to Chinese New Year.

Spring Festival is the most significant disruption. For commercial patio umbrella production, this involves a pre-holiday rush and post-holiday ramp-up.

- Secure Production Early: Confirm slots 4-6 weeks before Golden Week.

- Set an Early Shipping Date: Aim to ship 10 days *before* the holiday starts.

QC Standards for Commercial Patio Umbrellas: AQL 2.5/4.0 Inspections

AQL 2.5/4.0 is the statistical standard for ensuring consistent quality without inspecting every single unit.

When ordering thousands of commercial patio umbrellas, inspecting every single unit is not practical. Instead, we use the Acceptance Quality Limit (AQL) to verify quality.

- Critical Defects (AQL 0.0%): Zero tolerance. For a patio umbrella, this includes sharp metal edges or base failures.

- Major Defects (AQL 2.5%): Issues affecting function, like a broken tilt mechanism.

Dedicated workers expertly assembling a commercial canopy.

Payment Safety: Negotiating T/T vs. L/C for Bulk Orders

For large orders, a 30/70 T/T (Telegraphic Transfer) is fast and common. However, for high-value orders of commercial umbrellas, an L/C (Letter of Credit) offers a bank guarantee.

Sample Protocol: Pre-Production Costs for Commercial Patio Umbrellas

In 2026, a pre-production sample is a paid engineering milestone. Expect to pay US$100–$500+ per unit.

Understanding the process for getting a pre-production commercial patio umbrella sample is key. This sample fee functions as a paid engineering milestone to confirm material quality and print accuracy before mass production.

Final Thoughts

Sourcing directly from China is about managing risk. A single misstep in factory verification or QC can erase your margins. A transparent commercial umbrella manufacturing partner turns this complexity into a competitive advantage.

Frequently Asked Questions

How can I verify if you are a real factory?

We are a direct-from-factory manufacturer located in Linhai. You can verify our status by checking our business license and ISO 9001 certification. We also welcome you to visit our production line.

What is your lead time for commercial patio umbrellas?

Our standard production lead time for a 40HQ container of commercial patio umbrellas is approximately 25–35 days after artwork approval.

Why do you quote FOB Ningbo?

Our factory is located in Linhai, very close to Ningbo Port. Quoting FOB Ningbo saves you inland trucking costs compared to shipping from Shanghai.